The cryptocurrency space presents immense opportunities for growth and profit, but also comes with significant challenges. Fluctuations happen rapidly and individual coins can rise or fall dramatically in a short time period. Distinguishing successful traders from others often comes down to the tools and strategies they employ. This article will explore some of the most powerful crypto analysis tools available today to give you an informational edge.

Getting Started with Crypto Wallets

The first step for any crypto enthusiast is securing their digital assets safely. Crypto wallets provide a dedicated storage solution and interface to hold, send and receive supported cryptocurrencies. Hardware wallets like Trezor offer the highest level of security by keeping private keys fully offline on a physical device. Software wallets are also very popular due to their easy usage directly on a computer or mobile device.

However you choose to store your coins, seek out options with robust security features like multi-factor authentication, private key encryption, backup seeds and device firmware updates. Popular comprehensive options include the Ledger Nano S/X hardware wallet and Coinbase wallet as a software alternative. With crypto adoption rising exponentially, protecting your holdings properly is mission critical for long term success in the industry.

Maximizing Trading Potential with Exchanges

Once you have a secure storage solution, cryptocurrency exchanges unlock the ability to actively trade coins against other assets. As centralized trading hubs, exchanges provide crucial liquidity and order books that allow buyers and sellers to easily match pricing. Platforms like Binance handle massive daily volumes and support hundreds of digital currencies and trading pairs.

Beyond the core exchange functionality, advanced trading tools offer strategic advantages. Charting adds technical analysis capabilities through customizable price graphs and built-in indicators. Users can identify trends, monitor support/resistance zones and spot potential reversal signals. Many exchanges also integrate blockchain analytics to glean on-chain market behavior insights. Services like PrimeXBT up trading multiples with very high leverage. Novice and experienced traders alike benefit tremendously from maximizing exchange utilities.

Augmenting Trades through Automation with Bots

Automated cryptocurrency trading bots streamline the process of capitalizing on market movements through programmed rule-based strategies. Rather than constant manual monitoring, bots scan markets 24/7, interpret patterns and open/close positions autonomously according to predefined parameters. Popular options like Cryptohopper allow customizing indicators, stop-losses and profit targets for bots to execute systematically.

Backtesting trading algorithms against historical price data helps optimize parameters before going live. Running concurrent diversified strategies on multiple exchanges also spreads risk. As the crypto space evolves rapidly, bot capabilities continue advancing with machine learning integration and natural language programming. Though not a replacement for due research, well-configured bots free up time and help traders extract more value from the opportunities presented every day.

Implementing Advanced Portfolio Tracking

For a bird's eye view of your entire digital asset holdings, portfolio trackers consolidate pricing and market stats from wallets and exchanges into a single dashboard. CoinStats is a top all-in-one solution to monitor performances, convert values across currencies and access aggregated market insights for informed decisions.

Advanced charting within trackers also serves technical analysis purposes. Identifying trends across long time frames helps assess investment theses. Watching industry sub-sector dynamics reveals rotations between market categories. Correlating individual coin performances to macro events keeps perspectives current. Whether optimizing existing holdings or sourcing new opportunities, portfolio trackers streamline research significantly.

Comprehensive Market Analysis with Key Resources

In-depth market understanding helps navigate ever-changing cryptocurrency conditions optimally. Popular tools like CoinMarketCap and CoinGecko provide aggregated fundamentals like real-time pricing, trading volumes and individual coin market caps. Dominance charts reveal how capital shifts between coins. Sentiment metrics gauge crowd emotions.

Dedicated analysis platforms take insights further. TradingView supplies custom technical charting with over 30 built-in indicators. PrimeXBT offers advanced order types and risk management tools for enhanced trading. On-chain blockchain analytics through Nansen or Glassnode unpack network behaviors beyond simple price movements. Comprehensive news aggregation from CryptoPanic and CryptoSlate keeps awareness current.

Quality data sources serve as the backbone, but discerning reliable signals from noise also requires qualitative judgments. Long-term crypto success stems from proficiently synthesizing diverse quantitative and qualitative resources into coherent market thesis. Utilizing top platforms gives the analytical firepower needed to form and act on the most informed perspectives possible.

Maximizing ICO/IDO Opportunities Through Due Diligence

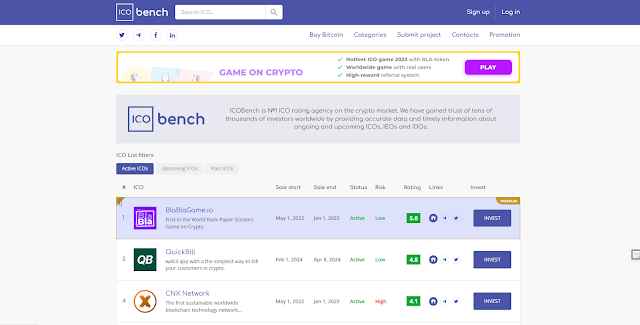

Initial exchange offerings present some of the strongest potential returns in the cryptoverse. Yet with opportunity comes risk, especially in speculative early-stage projects. Comprehensive research minimizes chances of backing failing ventures. ICO Bench and ICO Research Platforms systematically assess fundamentals like the management team, roadmap, tokenomics and engagement metrics to validate execution potential.

Diversifying across a portfolio of vetted projects theoretically guarantees exposure to breakaway hits that deliver 1000x or higher gains. Continuously tracking investment and community developments post-IDO serves risk management though monitoring platforms. While hype can create temporary price dislocations, projects solving real problems tend to sustain over the long run. With judicious pre-commitment scrutiny and post-investment oversight, IDOs represent a powerful tool for value creation.

Securing Holdings with Advanced Protection Mechanisms

In an increasingly connected world with sophisticated cyber-threats, underpinning digital assets with multi-level security delivers well-justified peace of mind. Hardware wallets like the Ledger and Trezor physically isolate private keys through proprietary chip technology impervious to malware or network intrusions. Mainstream smartphone authenticator apps add affordable second-factor authentication through 6-digit rolling codes.

Advancing one step further, services like Chainalysis monitor network flows for anomalous recycling behaviors indicating potential wash trading or other market manipulations. Incognito mode and decentralized exchanges like Biswap facilitate darkness transactions untraceable by analytics. With the rising stakes in cryptocurrency, prioritizing sophisticated security protocols remains a must for all participants from individual holders to large custodians.

Amplifying Expertise with Social Trading Platforms

By tapping into communities of skilled traders through platforms like eToro or PrimeXBT, beginning enthusiasts access detailed market analyses, educational content and the ability to automatically replicate top performing investor portfolios. Advanced charting and trade filtering aid strategizing custom watchlists. Popular traders rated by statistically verified performance serve as virtual mentors sustaining learning curves.

Community discussion facilitates exchange of techniques, perspectives and risk management best practices heretofore restricted within closed-circles of experienced pros. Automated trade mirroring automates strategic implementation. As cryptocurrency matures into an institutionalized asset class, platforms bridging knowledge gaps speed broader participation beyond initial tech-forward adopters alone. Societal benefits emerge as aggregated trading pools diversify individual-level risks.

Mastering Crypto with Advanced On-Chain Insights

On-chain cryptocurrency data analyses unpack microscopic transactions, wallet flows and network infrastructure to empower optimized decision making. Tools like CryptoQuant, Glassnode or Nansen visualize complex relationships across the distributed ledger invisible to standard tools. Holding periods, network velocity, reserves flows and exchange balances provide micro-indicators preceding mainstream narratives.

Quantfunds tap machine learning to surface recursive patterns from petabyte ledgers predicting short and medium-term price cycles. While no substitute for fundamentals-based research, on-chain metrics supplement technical and macro analyses zooming out to whole-network behavior beyond individual traders. Leveraging next-gen data resources separates best-informed analysts and traders empowered with “peek under the hood” supervision over opaque high-growth assets.

This comprehensive guide has outlined some of the most advanced cryptocurrency analysis tools available across critical categories like security, portfolio tracking, exchange functionality, signal processing and on-chain insights. Adopting robust solutions at each level strengthend long term strategies with quantifiable advantages difficult for retail participants to achieve in isolation. With continuous innovation, platforms helping participants extract optimal value from this burgeoning asset will define success over the next decade.

Conclusion

In conclusion, utilizing powerful crypto analysis tools is one of the most effective ways to gain valuable insights and make more informed decisions in the complex cryptocurrency sector. As digital assets continue to mature and evolve rapidly, advanced solutions that consolidate data, optimize strategies and provider security will help participants navigate changing market conditions with greater confidence.

While experience remains invaluable over time, leveraging top resources across categories like portfolio tracking, exchange utilities, algorithmic trading, on-chain analytics and social sentiment analysis can significantly enhance skills development for both new and experienced users. Adopting robust, feature-rich platforms that evolve with the industry will remain key to extracting optimal value from the wealth of opportunities emerging every day in this high growth innovative space.

FAQs

1. What is the best crypto portfolio tracker?

Some of the most popular options include CoinStats, Blockfolio and CoinMarketCap which offer comprehensive views of holdings across wallets and exchanges. CoinGecko is another excellent free option.

2. Which exchange has the best technical analysis tools?

Binance and FTX are often considered top choices due to their wide range of advanced charting tools and indicators. Kraken also provides robust technical analysis functionality.

3. How do crypto trading bots work?

Trading bots use predefined automated rules and strategies to open and close positions based on market signals and indicators. Popular options like 3Commas and Cryptohopper allow backtesting strategies on historical data.

4. What are the main types of on-chain cryptocurrency analysis?

Key areas include network exploration through metrics like hash rates, transaction volumes and velocity. Wallet behavior tracking analyzes flows, concentration and reserves. Exchange net positions provide insights into market-making activity.

5. Is technical analysis enough for crypto trading?

While technical patterns and indicators provide valuable inputs, a holistic approach factoring in fundamental analysis of individual projects, macroeconomic conditions and quantitative network insights tends to yield more robust longer-term strategies.

.webp)

.png)