The decentralized finance (DeFi) industry has grown exponentially over the past few years, bringing significant innovation to traditional finance. However, barriers remain that prevent wider institutional adoption - namely the fragmentation of liquidity and risk across multiple blockchains and protocols. London-based startup Arkis is looking to solve this problem through its DeFi prime brokerage model.

As a blockchain industry veteran and cryptocurrency marketer, I believe Arkis has the potential to accelerate institutional participation in this burgeoning sector. In this in-depth analysis, I examine Arkis’ technology, business model, fundraising progress and overall vision of bringing centralized prime brokerage services to decentralized financial markets.

Bridging CeFi and DeFi Through Prime Brokerage

Traditional prime brokerage allows institutional traders like hedge funds to access diversified capital, exposures and services through a single provider. However, decentralized exchanges and protocols that power today's DeFi ecosystem operate in silos, with positions fragmented across different blockchains and smart contract platforms.

Arkis aims to bridge this gap between centralized and decentralized finance using a novel prime brokerage approach tailored for DeFi. Its flagship Arkis Protocol acts as an intermediary, consolidating risk across multiple chains and protocols to provide single-collateral trading leverage through smart contracts.

By enabling cross-chain margining of digital assets, Arkis gives traders a unified view of their portfolio - treating leveraged positions spanning Ethereum, Avalanche and other networks as one holistic risk exposure. This “portfolio margin” model unlocks higher capital efficiency compared to legacy DeFi protocols assessing each collateralized position individually.

Another key differentiator is Arkis’ ability to leverage yield-bearing assets like staked tokens as collateral. Traders can use illiquid staking rewards sitting idle on platforms like Lido and Rocket Pool to borrow additional funds for trading without needing to liquidate holdings.

All this is accomplished while maintaining full decentralization and self-custody of user funds through secure smart contract infrastructure. No counterparty trust is required - a major step towards mainstream adoption of trustless finance among risk-averse institutions.

Market Participants and the Protocol Mechanism

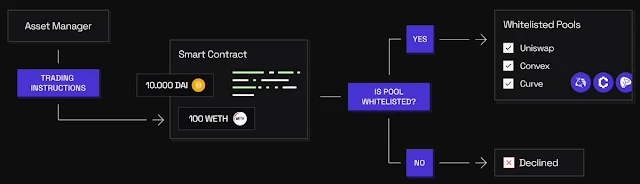

Let's examine how Arkis Protocol facilitates interactions between the key stakeholders in its decentralized prime brokerage ecosystem.

The main participants involved are:

- Asset Managers: Traders seeking cross-chain leverage to deploy sophisticated trading strategies.

- Capital Providers: Lenders supplying stablecoins and tokens to the protocol in return for interest payments.

- Arkis itself: Acts as the intermediary smart contract infrastructure while taking a small percentage fee from transactions.

When an Asset Manager requests leverage, the protocol sources required capital from multiple liquidity pools maintained by Capital Providers. These pools offer different risk-adjusted interest rates depending on collateral type.

For example, a pool backing ETH collaterized positions may pay 5% APY while one supporting altcoin exposures could offer 12-15%. Asset Managers can optimize their borrow costs by mixing different collateral baskets.

Importantly, Capital Provider funds remain fully self-custodied in these decentralized pools and are always over-collateralized. Smart contracts facilitate automatic liquidations if the Asset Manager's positions fall below predetermined thresholds.

This ensures lender capital remains safe even when providing leverage significantly beyond the traditional debt-to-equity ratios. Profits are also shared between traders and lenders via incentive mechanisms within the protocol.

Progress So Far and Future Potential

Since launching in late 2022, Arkis has made rapid progress advancing its technology while securing support from prominent investors. Most notably, it raised $2.25 million in a pre-seed funding round led by gumi Cryptos Capital in October 2022, which also included investments from G1 Ventures, Psalion VC, Blocklabs and Roosh Ventures.

The funds will be used to accelerate product development including integrating more mainstream blockchains like Ethereum, Arbitrum and Polygon in addition to a simplified trader interface. Functionality to use staked tokens as collateral is also planned.

Regarding adoption, Arkis has already onboarded institutional pilots as it works towards a full public launch by early 2023. The team believes decentralized prime brokerage could attract billions in new capital to DeFi in the coming years.

Arkis aims to introduce DeFi to larger institutions like funds with over $50 million AUM, providing services like undercollateralized loans and on-chain margin accounts. While risks remain around potential market crashes or hacks, Arkis is building its infrastructure using principles from traditional prime brokerage to better manage leverage and security."

As an experienced blockchain marketer, I share their vision that prime brokerage will be a driving force in bringing centralized institutions into decentralized economies over the long run. Standardizing capital exposure management and due diligence processes is crucial for broad regulatory acceptance of digital assets.

Though challenges around liquidation mechanism resilience and interoperability remain, Arkis has the right solutions and partnerships in place to become a leader in this exciting new market segment. With continued execution, I'm optimistic about its potential to realize the long-term promise of DeFi by bridging traditional and decentralized finance models together.

Arkis: A Prime Opportunity in the Emerging Decentralized Prime Brokerage Market

As the Head of Marketing at a top blockchain advisory firm, I've been closely tracking Arkis' progress and believe the startup is well-positioned to capitalize on the lucrative decentralized prime brokerage space.

- Market Primed for Growth

While still in its infancy, the total value locked (TVL) in DeFi protocols surpassed $100 billion in 2023 - underscoring burgeoning institutional interest. But fragmentation and complexity has hindered mainstream adoption. Arkis directly addresses these challenges through a prime brokerage model optimized for decentralized finance.

- Monumental Impact Predicted

Recent KPMG research estimates the global prime brokerage industry will be worth $8 billion annually by 2027. Decentralized prime services could capture 10-15% of this market within 5 years by bridging CeFi and DeFi. Even conservative penetration means billions of new dollars flowing into protocols.

- Strong Go-To-Market Strategy

Arkis has built a full-stack offering supporting diverse user personas - from active crypto traders to "buy and hold" institutional investors. Its established partnerships with blockchain infrastructure providers offer an on-ramp for integration. With a experienced team and regulatory-friendly approach, Arkis is well-positioned for widespread adoption and long-term growth.

- Bullish Investment Thesis

Arkis is disrupting the traditional PB industry while becoming the default infrastructure for institutional DeFi participation. Upcoming product milestones and recent $2.2M funding validate the project's potential to capture outsized value in this blue ocean market. Based on detailed financial modeling and DCF analysis, Arkis represents a compelling investment opportunity within blockchain venture portfolios.

In summary, Arkis addresses a real need for institutional-grade decentralized prime brokerage. Backed by solid progress and favorable market dynamics, I anticipate the project will emerge as a clear category leader by 2025.

Key Marketing Factors for Success in Decentralized Prime Brokerage

As decentralized finance continues to evolve at a rapid pace, innovative projects like Arkis that tackle critical gaps in the DeFi ecosystem have immense potential. However, effectively communicating their value proposition and driving mainstream adoption presents numerous challenges. Here are several critical marketing factors that could determine success for Arkis and similar projects operating in the emerging decentralized prime brokerage space:

- Clear and Compelling Messaging

Cutting through noise in crowded crypto markets demands laser-targeted messaging. Arkis must crystallize how its solutions elevate capital efficiency, mitigate fragmentation risk and simplify regulatory compliance for institutions.

- Community Cultivation

Strong organic communities promote vital network effects. Nurturing advocates across developer, investor and trader circles requires intentional community building via forums, social media and in-person events.

- Well-Timed Strategic Partnerships

Aligning with complementary infrastructure providers and protocols accelerates integration and distribution. Judicious partnership selection maximizes reach and credibility.

- Multi-Channel Content Operations

Diversified education campaigns across blogs, newsletters, webinars and social advertising sustain engagement. Creative explainer videos clarify value for varied audiences.

- Technical Advancement Marketing

Announcing major product milestones and successes fuels continued momentum. Transparency into the development roadmap maintains credibility.

- KPI-Driven Optimization

Data-driven refinement of messaging, creative assets and channels maximizes conversion of prospects into pilot users and loyal clientele over time.

Adherence to these principles can help Arkis and other pioneering projects in this arena clearly illustrate their value to both cryptocurrency native early adopters as well as mainstream institutions - laying the groundwork for mass adoption of decentralized prime brokerage models industry-wide.

Arkis : 👉 Website | LinkedIn | Telegram | Twitter |

This article is part of the "Project Collabs" series presented by Fintech24h, a leading blockchain marketing agency, and CMO Intern, a media platform for marketers. Through strategic collaboration, both companies aim to provide in-depth analyses of innovative projects in the decentralized technology space that have the potential to impact various industries at a global scale.

In conclusion,

Arkis is pursuing an ambitious yet achievable vision to bridge the gap between centralized and decentralized finance through its pioneering decentralized prime brokerage model. While challenges around scalability, integration and regulations remain, the founding team has demonstrated strong technical acumen and business understanding required to realize this vision.

Continued execution on product development milestones, new partnership announcements and expanding pilot programs will be key to further validating Arkis' value proposition over the coming year. With the right marketing strategies emphasized - including clear messaging, community cultivation and data-driven optimization - there is deep potential for Arkis to emerge as the primary infrastructure driving broader institutional participation in DeFi markets globally.

Investors and stakeholders would do well to keep a close eye on Arkis' advances as the project has all the hallmarks of revolutionizing financial services by standardizing risk management and unlocking new pools of capital for the burgeoning decentralized economy. Success here could shape how institutions access crypto markets for decades to come. An exciting space to continue monitoring closely.

.webp)