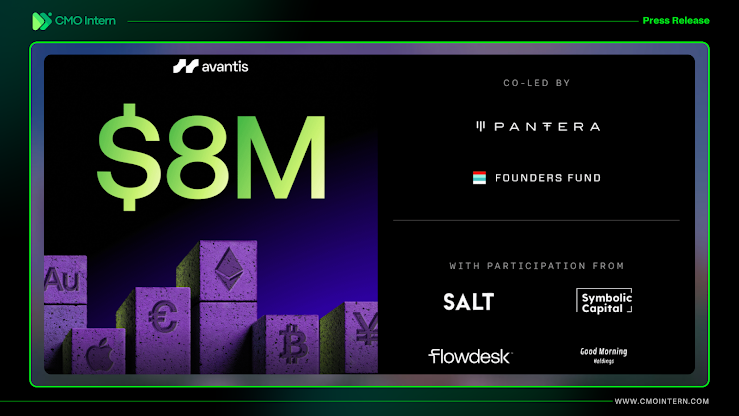

June 4, 2025 – Avantis, the innovative on-chain exchange designed for leverage trading across cryptocurrencies, forex, and commodities, today announced the successful closure of its $8 million Series A funding round. This latest investment brings Avantis's total funding to $12 million, following a $4 million Seed round in September 2023. The Series A round saw significant participation, including Peter Thiel's Founders Fund, underscoring strong investor confidence in Avantis's vision to revolutionize decentralized finance (DeFi) by bridging crypto and global asset markets.

Avantis is on a mission to build products that uniquely combine crypto and global assets, creating "One DEX, infinite strategies." The protocol empowers on-chain traders to express global macro views, leveraging the power of decentralized finance to access a wide array of synthetic assets with up to 100x leverage. This capital-efficient approach, combined with a USDC stablecoin LP, allows for a broad selection of tradable assets, from Bitcoin and Ethereum to the Japanese Yen and Gold, all within a single terminal.

"We envision a world where leverage can be meaningfully used to trade and market-make not just crypto, but real-world assets, sports, prediction markets, and much more," stated a representative from the Avantis Foundation. "That's what we're building: One DEX, infinite possibilities. This funding validates our pioneering approach and will accelerate our development to bring institutional-grade trading capabilities to the decentralized world."

Avantis has introduced several innovative mechanisms that set it apart in the DeFi landscape:

- Loss Rebates: A unique feature providing a rebate on losses for certain trades, designed to balance the platform's open interest skew.

- Positive Slippage: Offering better than market entry prices for trades that help balance open interest skew, benefiting traders.

- Real-World Asset (RWA) Access: Enabling seamless trading of traditional financial assets like forex and metals alongside cryptocurrencies.

- Advanced Risk Management for Liquidity Providers (LPs): LPs can passively deposit USDC or become active market makers by choosing a risk tranche and defining their time-lock, unlocking fine-grained risk management.

- Guaranteed SLs/TPs: Providing traders with guaranteed Stop Loss and Take Profit orders, a critical feature for risk management.

- Zero-Fee Perpetuals (ZFP): Introducing a new fee structure designed to enhance capital efficiency and reduce trading costs.

The Avantis protocol is developed by the Avantis Foundation, comprised of 11 crypto-native individuals with over 20 years of cumulative experience in engineering, investment banking, consulting, venture capital, private equity, incentive design, and product development. This deep expertise ensures the protocol's robust design and continuous innovation.

As a DeFi protocol operating within the Base and Optimism ecosystems, Avantis is poised to drive the next wave of decentralized trading. The platform's focus on transparency, efficiency, and advanced risk mitigation positions it as a leader in the evolving landscape of on-chain derivatives.

Users are invited to explore the Avantis platform, its comprehensive documentation, and join its vibrant community to experience the future of cross-asset leverage trading.

About Avantis:

Avantis is an advanced on-chain exchange for cross-asset leverage trading, enabling users to long or short synthetic cryptocurrencies, forex, and commodities. Built on a capital-efficient model with USDC stablecoin liquidity, Avantis offers up to 100x leverage and unique features like Loss Rebates, Positive Slippage, and advanced risk management for liquidity providers. Developed by the Avantis Foundation, Avantis is committed to democratizing access to institutional-grade trading strategies within the DeFi ecosystem.

Compiled by CMO Intern team

.webp)